Court Memo Details $350K+ Probate Valuation Gap Linked to Affordable Housing Board Member

Court Memo Details $350K Probate Valuation Gap

Linked to City Affordable Housing Board Leadership.

Pro Se Tenants Continue to Face Exploitative Tactics When They Seek Justice

An Analysis of How Court Procedures, Counsel Conduct, and Information Asymmetry

Perpetuate Housing Injustice Even After Litigation Begins

Defense AI Disclosure Motion: Pre-AI Case History Disproves Competence Suspicion

Lawyers Question Pro Se Competence, Miss Basic Docket Search Showing Strategic Legal Arguments Pre-AI Against Their Own Client

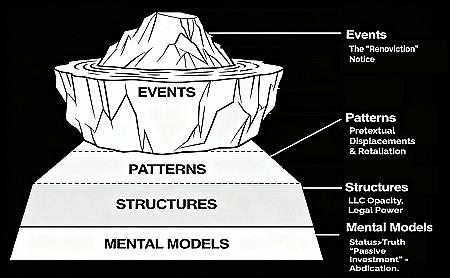

Why Systems Thinking and Strategic Thought Leadership in Housing Justice?

As systems thinker Russell Ackoff said, "A bad system will beat a good person every time."

The Altman Files: When Public Trust Meets Private Extraction

Court Filing Reveals City Affordable Housing Commissioner Linked to 95% Asset Devaluation, "Flash Transfers," and Displacement of 5-Year Tenants in Good Standing.

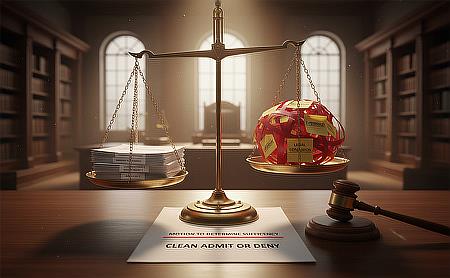

Discovery Is Not a Word Game: Motion to Determine Sufficiency of Defendants’ RFA Response

When “vague and ambiguous” becomes a strategy, Requests for Admission stop narrowing issues and start hiding them. Motion seeks court intervention after defendants deployed coordinated "vague and ambiguous" boilerplate to avoid clean admissions.

Meridian Residential Group’s Privacy Invasion: Unauthorized Family Images Published Across 25+ Platforms

Meridian Residential Group published and distributed photos of plaintiffs, their older family dog in diapers, and their belongings on at least 25 websites for months without the tenants' knowledge or consent The set of ~15 still images, taken during an "inspection" with no permission given for public publishing, appeared on sites like Zillow, Realtor.com, and others. The Matterport Virtual Tour published over the same general time period also contradicting how it was framed: with a promise of AI removal in its case.

When Two Firms Coordinate to Hide Evidence Before a Regulatory Deadline

Coordinated Obstruction, Unconsentable Conflicts, and Witness Tampering in Real Time

The Health Crisis Filings: Tenant Harm Weaponized Through Defense Gaslighting

Defense Claims 'Threats' After Criminal Complaint Filed, Gaslighting Pattern Produces PCL-5 Score of 76/80, Co-Plaintiff Intervenes as ADA Accommodations Requested

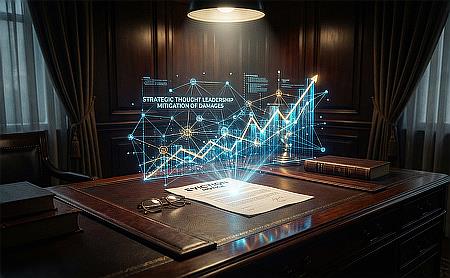

Mitigation of Damages with Strategic Thought Leadership Demo

Proving to a Jury the Value of what was lost through re-launching it Using this Case as a Leverage Point for Paradigm Change in Housing:

A Real-Time Demonstration of the Power of the Destroyed Platform.

Experience it for yourself: Test with Interactive Links Below.

Housing Justice Audit Report (Draft)

A scathing condemnation of the "Unconscious Abdication" Mental Model behind "Passive Investing" and the viscous cycles of harm it causes in the Charleston, SC Housing and Housing Justice System.

And a clear plan for true positive change.